May 29, 2025

Nvidia Earnings – Unshaken AI Dominance Despite the China Revenue Gap

Ryunsu Sung

Nvidia has once again overwhelmed the market with its numbers. It guided for $45 billion in second-quarter revenue, effectively neutralizing the expected $8 billion hit from export restrictions to China. The figure was exactly in line with market expectations, and the stock climbed 4% in after-hours trading.

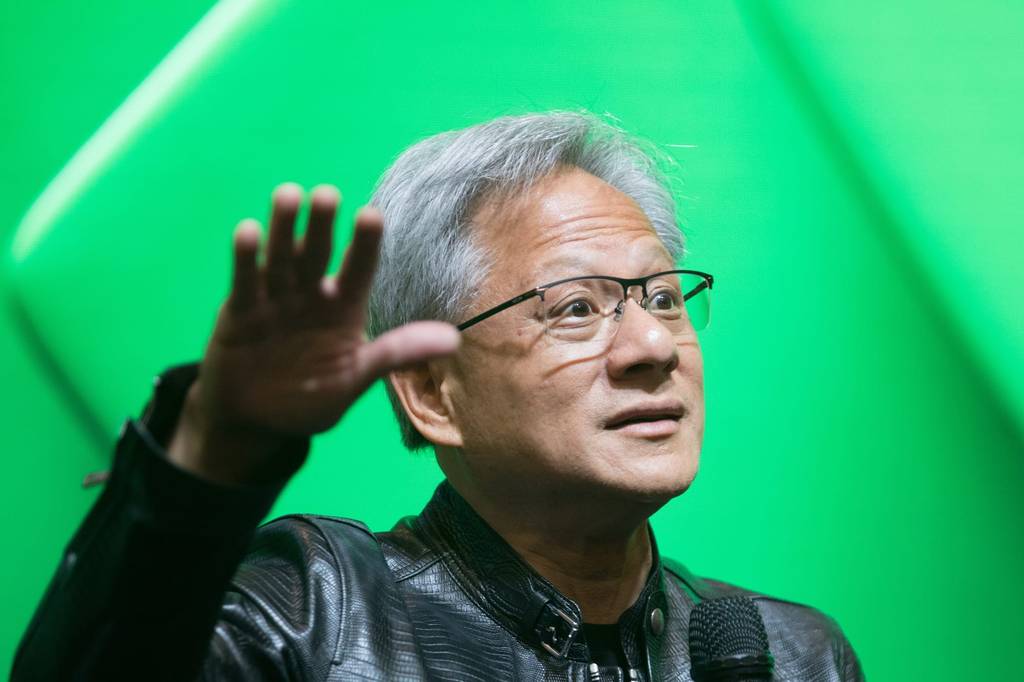

This earnings release gave the impression of sweeping away the cloud hanging over the AI market in one stroke. On the conference call, CEO Jensen Huang stressed that “the AI computing market is still growing exponentially,” adding that governments around the world see AI as the core infrastructure of the next industrial revolution. He particularly highlighted that production of the company’s latest chip architecture, Blackwell, is ramping up, and that its strategy of bundling chips into AI supercomputer systems and selling them as a package is now entering full swing.

First-quarter revenue came in at $44.1 billion, up 69% year-on-year. While the growth rate slowed from the previous quarter (the lowest in two years), it still beat the market consensus of $43.3 billion. Earnings per share were $0.96 on an ex-one-off basis, topping the $0.93 estimate. Data center revenue was $39.1 billion and gaming revenue $3.8 billion, each meeting or significantly exceeding market expectations.

But China remains a source of unease lurking behind the earnings sheet. Since April, the U.S. government has blocked exports of data center chips to China, forcing Nvidia to book $4.5 billion in inventory write-downs. The company also concluded that further downgrading performance on the H20, a China-specific cut-down product, is no longer realistic. Jensen Huang said, “We cannot build products that have no use,” noting that internal discussions have begun on alternative solutions, though he drew a line by saying there are no concrete plans yet.

Conditions within China are also far from easy. After the Mellanox acquisition, Chinese regulators required Nvidia to continue supplying chips to domestic firms, and the company has said that failing to comply could expose it to fines or business restrictions. Authorities are currently investigating whether Nvidia’s adherence to U.S. export controls constitutes discriminatory treatment of local customers.

Even under these constraints, Jensen Huang made it clear that Nvidia cannot walk away from the Chinese market. “China’s AI accelerator market will soon grow to a $50 billion opportunity,” he said, warning that losing this market would not just mean a revenue hit, but could undermine Nvidia’s global AI leadership itself.

Meanwhile, the U.S. government has recently unveiled a series of large-scale AI projects centered on the Middle East, signaling a push to open up new markets. This runs counter to the Trump administration’s earlier stance of curbing AI technology exports. For Nvidia, this creates room to use these regions as an alternative outlet to offset China.

The problem, however, is expectations. With a market capitalization above $3 trillion, Nvidia now accounts for 10% of the entire Nasdaq. Investors no longer demand ever-higher growth; they simply take it for granted that the company will remain overwhelmingly dominant. The moment Nvidia falls even slightly short of that expectation, skepticism about the AI boom will resurface.

Newsletter

Be the first to get news about original content, newsletters, and special events.